Read the case given below and answer the questions given at the end.

CASE STUDY - I

A Family

Affair

The market for hair care products, worth Rs 692 crore, is growing at a sober 8 per cent. It is split into four major portions. By value, hair oils account for 45 per cent of it, shampoos 31 per cent of it, hair soaps 15 per cent of it and hair dyes 9 per cent. Styling gels may have found their way at the top; however, the majority of people continue to look after their tresses the traditional way, through oiling. 'Hair oils are seen as pre-wash nourishes, while shampoos are used as cleaners'. This market boasts of 343 variants under 40 brands. Shampoos began as an elitist thing, although for decades, the product suffered from the misperception that the chemical formulation could harm your hair in the long term. However, the 8ml pack wave has expanded the market tremendously by lowering the trial purchase barrier. Many, who have not used shampoos yet, are still using hair soaps. The leading brands - Wipro, Shikakai, Swastik Shikakai and Godrej Shikakai - enjoy a 'herbal' image in tune with the traditional hair-care methods.

The Market

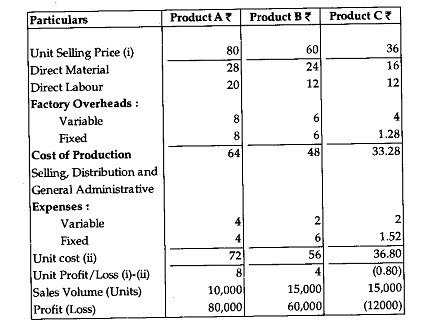

Low priced sachets are enabling marketers to increase urban as well as rural penetration. Price and packaging are by far the most attractive parts of the shampoo market. The ORG MARG data shows the following details:

The Leader

HLL leads the Indian shampoo market with its top selling brands Clinic and Sunsilk. Clinic Plus was launched in 1972 as a therapeutic offering that claimed to prevent dandruff. At that time, Sunsilk and Halo dominated the Indian market. Brand extensions followed to Clinic - Clinic All Clear and Clinic Active. HLL now had a shampoo for everyone.

Market Ratings

Clinic entered the A and M Top Brand Survey at no. 34 with a score of 22.54. It fared well in the South (30.11),however, not too well in the West (11.85). It did fairly well with young adult females (31.12) than the males. It scored high in the large urban towns (25.90), however, not so much in the metros (23.50). It also made gains in the rural areas (35.89), thanks to its sachets, though some analysts pointed to the feel-good factor (better crop output, etc.). Clinic scored highest in the rural segment, which was something Head and Shoulders should have noted.

Marketing Plans

HLL plans to increase its market share to 35 per cent by the end of this year. Marketing research has revealed that the single most important factor that would make consumers buy would be the number of washes offered. The Clinic Plus bubble pack, would offer more value to sachet users - no spillage, dosage control, easy to store and at Rs 8 for a 28 ml pack, the price per ml worked out a little cheaper compared to an 8 ml sachet, which costs Rs 2.50. HLL spends heavily on advertising and promotions. Road shows have also been implemented widely to give the consumers a touch and feel experience. Other activities for the brand have included wall paintings and demonstrations in schools.

Questions:

Q1. Evaluate the market for shampoos in terms of the potential of various pack sizes in the rural and urban markets.

Q2. Critically evaluate the performance of Clinic Plus in different markets.

Q3. In order to increase HLL's market share, suggest an appropriate strategy in terms of the markets, the consumers, the pack sizes, etc., to focus on.